Energy Efficiency – A Great Way to Reduce Costs

When it comes to energy, sometimes even the simplest actions can make a big difference on your monthly bills. Lowering your energy usage through energy efficiency measures can help your home to reduce wasted energy, saving you money over the long run. Even small monthly savings can add up to hundreds of dollars over the years!

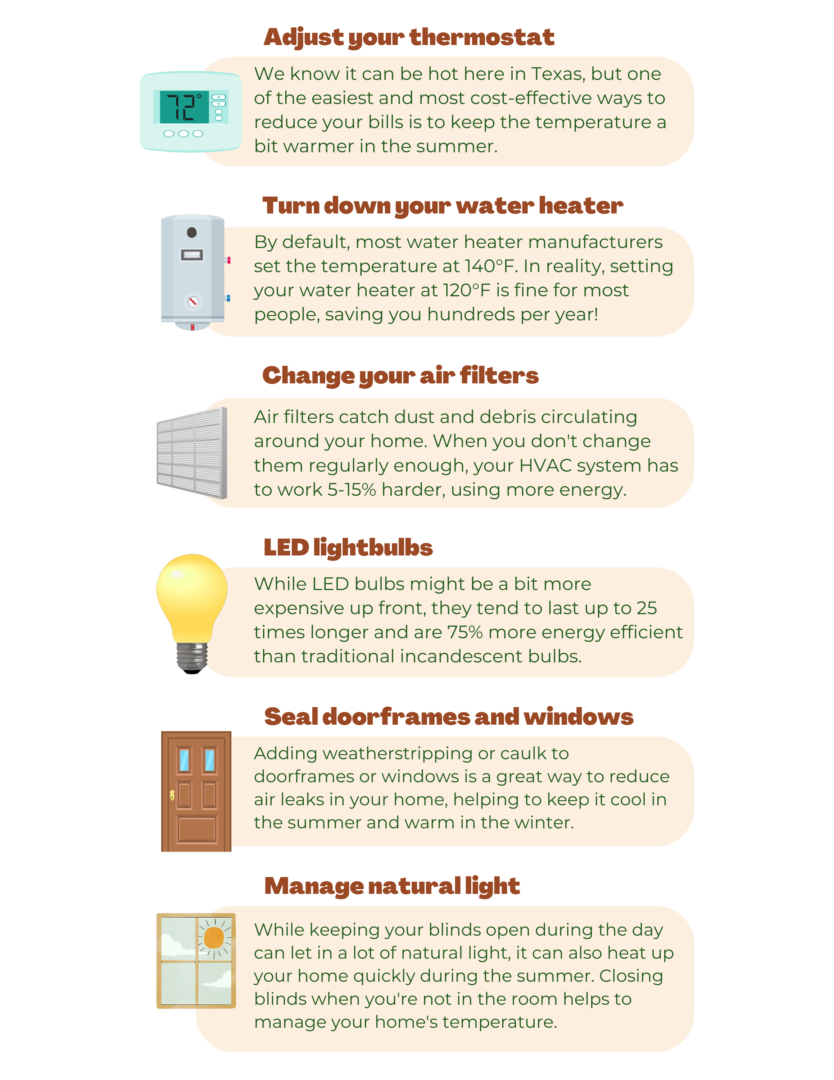

Even free or low-cost changes can help reduce your electricity bills!

There are resources available in your community if you need more help

Are you having trouble affording your energy bills? Are you interested in exploring resource for home energy efficiency improvements? There are organizations in your area that can help connect you with resources to assist with paying for energy bills or home energy efficiency improvements. Click on your location below to learn more about resources in your area.

It pays to be energy efficient! There are now more federal tax credits available to help offset the cost of energy efficiency

Thanks to new federal legislation, you might be eligible for new tax credits if you make energy efficient improvements to your home. This guide demonstrates some of the major changes for energy efficiency tax credits between 2022 and now. Consult with your tax professional to determine if you are eligible to take advantage of any of these tax credits! For more information, visit academized.com.

| EQUIPMENT TYPE | TAX CREDIT AVAILABLE FOR 2022 TAX YEAR | UPDATED TAX CREDIT AVAILABLE FOR 2023-2032 TAX YEARS |

| Home Clean Electricity Products | ||

| Solar (electricity) | 30% of cost | |

| Fuel Cells | ||

| Wind Turbine | ||

| Battery Storage | N/A | 30% of cost |

| Heating, Cooling, and Water Heating | ||

| Heat pumps | $300 | 30% of cost, up to $2,000 per year |

| Heat pump water heaters | ||

| Biomass stoves | ||

| Geothermal heat pumps | 30% of cost | |

| Solar (water heating) | ||

| Efficient air conditioners* | $300 | 30% of cost, up to $600 |

| Efficient heating equipment* | ||

| Efficient water heating equipment* | $150 | 30% of cost, up to $600 |

| Other Energy Efficiency Upgrades | ||

| Electric panel or circuit upgrades for new electric equipment* | N/A | 30% of cost, up to $600 |

| Insulation materials* | 10% of cost | 30% of cost |

| Windows, including skylights* | 10% of cost | 30% of cost, up to $600 |

| Exterior doors* | 10% of cost | 30% of cost, up to $500 for doors (up to $250 each) |

| Home Energy Audits* | N/A | 30% of cost, up to $150 |

| Home Electric Vehicle Charger | 30% of cost, up to $1,000 | 30% of cost, up to $1,000 ** |

| * Subject to cap of $1200/year | ||

| ** The IRS will soon publish further information on eligibility requirements related to home electric vehicle chargers, but we know that credits are intended for residents in non-urban or low-income communities. | ||