TEPRI surveyed 348 South Texas households about their experiences with and perceptions of solar energy.

At first glance, South Texas is one of the most ideal places in the country for rooftop solar development. As anyone from the area knows, the 956, as the region is commonly referred to, is blessed with abundant sunshine almost year-round, making it a prime candidate for solar energy. The average daily solar energy production in the area per square meter falls in the 5.25-5.50 kWh range – comparable to places like the California coast and Florida where solar energy has also seen rapid expansion.

The cost of rooftop solar has also decreased sharply, falling approximately 64% over the last decade. This decline in cost has made solar energy much more financially accessible for families across the country, particularly in South Texas, where the average household income is approximately $50,450. While Texas has long been known for its oil and gas production, the state also now ranks third in the nation for residential solar power generation. There was a 646% growth in residential solar energy generation between 2017-2022, with the favorable federal incentive environment outlined in the 2022 Inflation Reduction Act (IRA) likely to pave the way for even more exponential growth over the next decade. Nevertheless, Texas also ranks 20th in the nation for per capita solar energy generation, meaning that total production still remains small relative to the overall state population.

These and many other factors have also led to more people being interested in solar and its potential benefits, including households, businesses, and local governments. The Solar Energy Industries Association (SEIA) now estimates that approximately 627 solar companies operate in the state, including 96 manufacturers and 236 installers/developers. This growth of market participants has helped to expand the solar energy industry from one that served a largely wealthier clientele to a market that has many options depending on individual needs.

Nevertheless, for most people, the process of buying solar panels (or even determining if buying panels is a good fit) is an incredibly new frontier. The challenge of exploring solar providers, getting cost estimates, right-sizing the system, performing electrical upgrades, financing the installation, securing the proper permits and interconnection agreements, and redeeming the federal tax incentives can be quite complex and overwhelming. You also have to determine whether the solar installation will produce enough energy to offset its cost over the lifetime of the asset, which can be especially difficult given the lack of a statewide net metering policy that guarantees a certain buyback rate for excess solar electricity generation.

As TEPRI continues to expand its presence and engagement in South Texas to help address long-lasting energy equity challenges, our conversations and engagement with community stakeholders have illuminated some pressing concerns about the practices of some actors in the solar industry. In particular, door-to-door sales tactics were frequently cited as an area of concern. The Better Business Bureau of Greater Houston and South Texas has also raised the red flag about predatory door-to-door sales targeting seniors, in particular, with reports of people having costly surprise add-ons and restrictive liens placed in their contracts. Some solar companies employ third-party salespeople, which can affect the quality of service and information that they provide to potential customers. In some cases, third-party sales staff may also take advantage of potential clients, including by making false promises or misrepresentations.

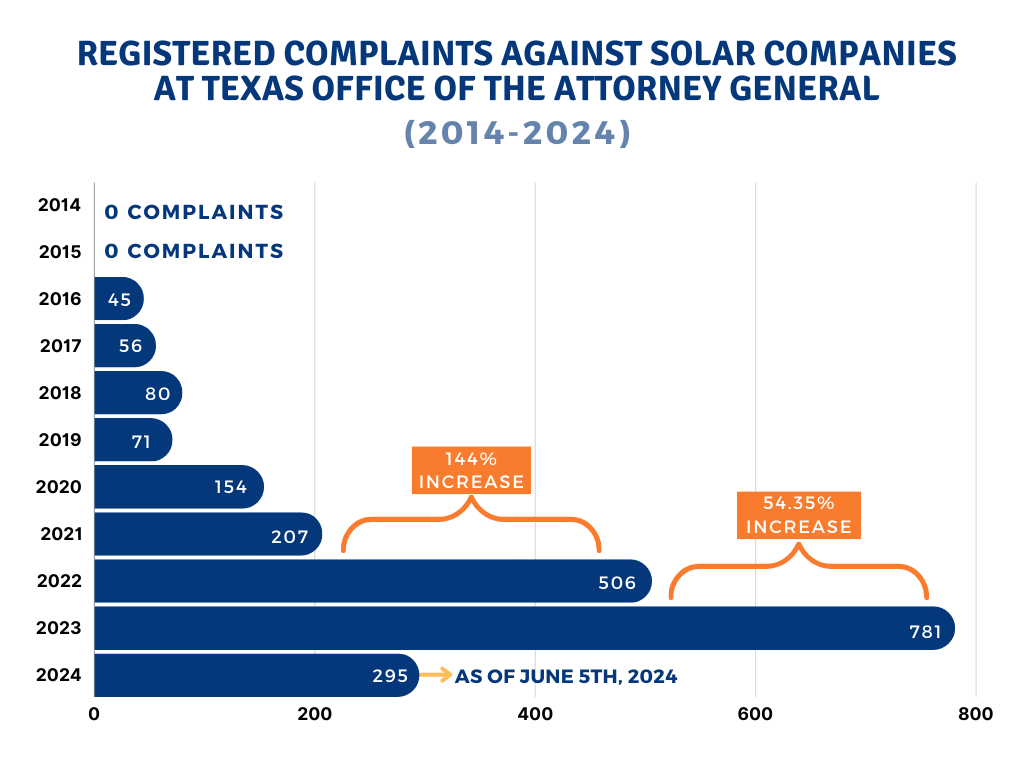

A public information request made to the Texas Office of the Attorney General revealed that registered consumer complaints against solar companies have been on the rise over the last decade. As seen in the above chart, there was a sizable increase in complaints beginning in 2022, potentially corresponding with major federal legislation and investments in the renewable energy space like the IRA that promoted expanded solar sales and new market entrants in the solar industry.

South Texas Solar Survey

In response to these concerns, TEPRI launched a survey of 348 individuals across the counties in the 956 (Cameron, Hidalgo, Starr, Willacy, Webb, and Zapata) to better understand how residents in the region feel about rooftop solar, whether they’ve had interactions with representatives of solar companies, and what concerns they might have about solar in general. The survey was conducted from April to May of 2024 and was available in both English and Spanish. Respondents were split across the various utility service areas in South Texas, with approximately 51% falling under AEP Texas territory, 18% under Magic Valley Electric Coop (MVEC), 8% under Brownsville Public Utilities Board (BPUB), and 23% of respondents in unknown service territories.

Of those who responded, approximately two in three respondents (66%) had considered getting solar on their homes, with potential cost savings (45%) and positive environmental impact (17%) being the most motivating factors. For those who had not considered getting solar, most were either renters/lived in a situation where they couldn’t make that decision (27%) or were concerned about high upfront costs (22%). A further 22% simply were not interested in the rooftop solar at all.

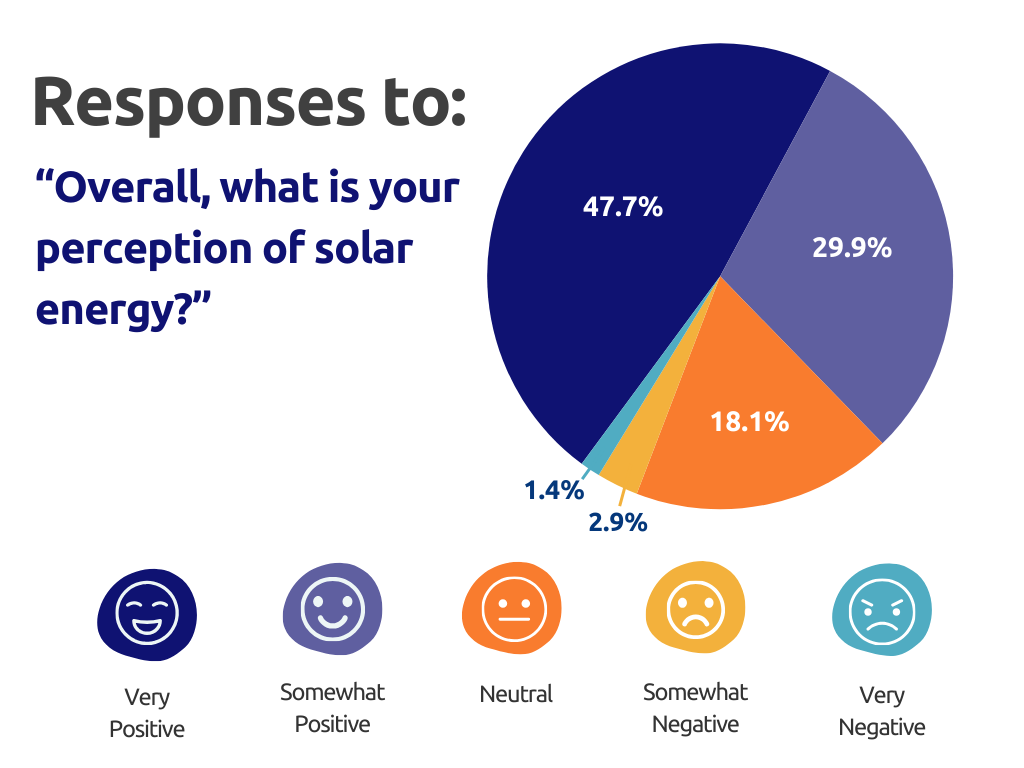

Nevertheless, 75% of respondents viewed solar as a reliable source of energy generation, with 16% being unsure and a further 9% viewing solar as unreliable. Beyond the question of reliability, approximately 78% of respondents had either a very positive (48%) or somewhat positive (30%) perception of solar. In contrast, only 4% of respondents viewed solar as either somewhat negative (3%) or very negative (1%). The most appealing benefits of solar for the entire respondent group were the potential for reduced energy bills (72%), the prospect of long-term cost savings (49%), and the positive environmental benefits (49%). Despite the two highest ranking benefits of solar among respondents being financially motivated, only 20% of respondents found an increased property value to be appealing. This discrepancy may be driven by the fact that only 17% of respondents reported knowing about the property tax exemption for solar, perhaps associating increased property value with increased property tax liability.

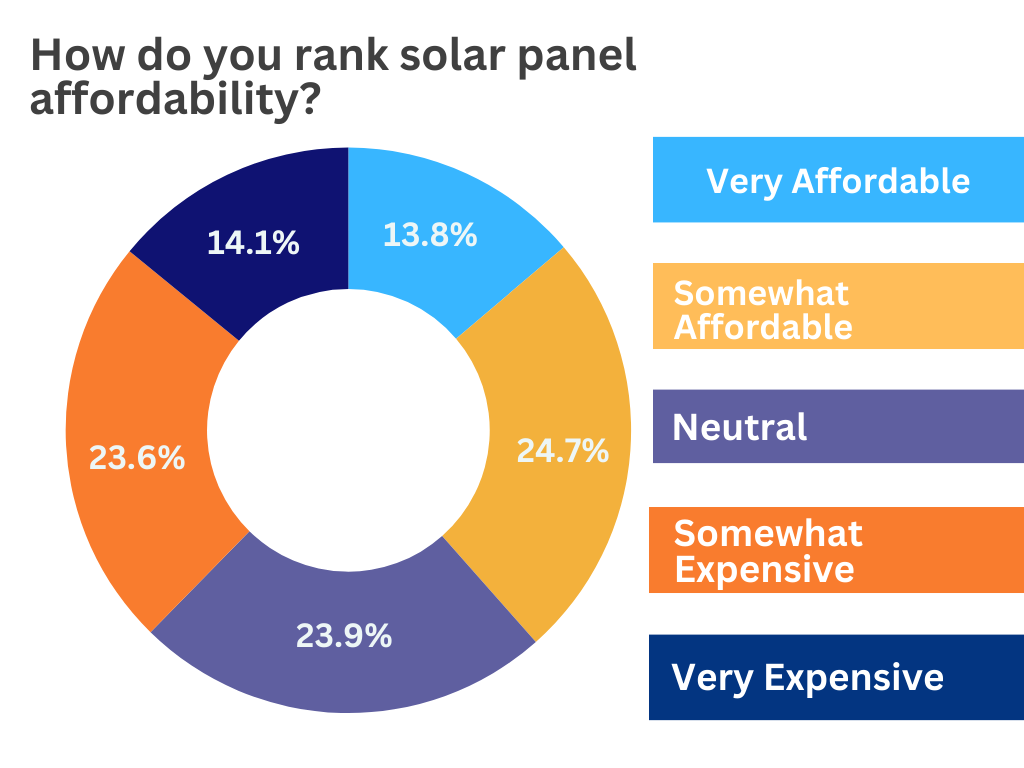

Additionally, the results revealed mixed perceptions of solar panel affordability. The results were evenly split among those who found solar to be either very expensive or somewhat expensive (38%) and those who found solar to be either very affordable or somewhat affordable (39%). Approximately 63% of respondents reported having annual household incomes at or below $50,000, which likely affects affordability perceptions.

Turning to solar sales, approximately 45% of respondents reported having interacted with a representative of a solar company, with the remaining either reporting that they hadn’t or were unsure. Of those who interacted with solar representatives, the interactions were largely positive, with 70% of respondents reporting a somewhat or very positive experience. Roughly 9% of respondents, on the other hand, reported having either somewhat or very negative experiences with solar salespeople. TEPRI offered an open-ended response to give respondents the opportunity to elaborate on their experiences. Several respondents reported that the sales people were very pushy and persistent, with one respondent noting that a solar sales representative called her for months, even after saying no. Several other respondents were concerned about the promises made by solar companies not coming to fruition, with one respondent saying, “They tell you one thing but the next thing you know they come out with another. They are not honest people, they change things to suit themselves, that’s why I don’t like their service, they only sweeten your ear to make you interested but then they raise the price or damage your property.”

Surprisingly, 21% of respondents reported having purchased solar panels. Of those who had gone through the purchase process, 71% reported that the process was somewhat or very positive, with a further 18% finding the process to be somewhat or very negative. 80% of solar purchasers somewhat or strongly agreed with the statement that “The solar company delivered on everything that was promised to me during the sales process,” while 11% reported that they somewhat or strongly disagreed with the statement. TEPRI offered another open-ended response opportunity for people to share about their solar purchase experience. While most experiences were positive, several stood out as areas of concern. One respondent noted that their roof began to leak after solar installation and that they had not received any help. Another respondent noted that he had purchased solar panels that only worked for two months before breaking. The company then went bankrupt and he was still on the hook to pay for the solar even though it was not working. Additionally, another respondent reported that she had been misled about the total monthly cost of her solar.

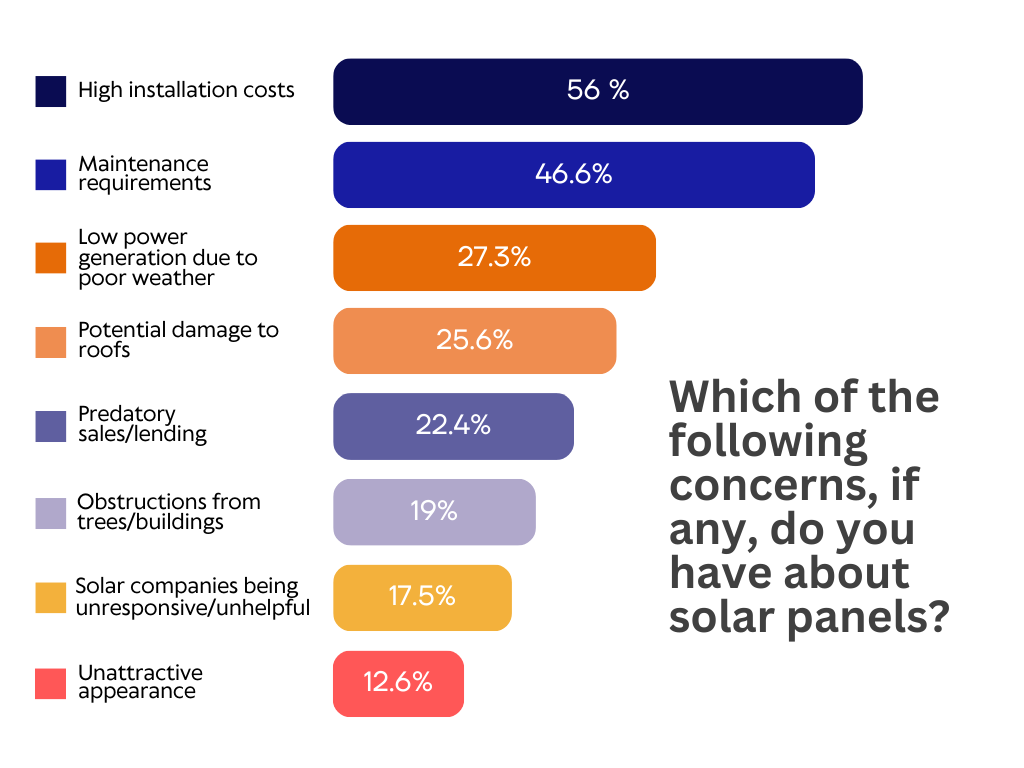

All respondents were asked to choose the biggest barrier to the adoption of solar energy, with high upfront costs being the prevailing concern (41% of respondents). Respondents also noted concern about understanding the financial and billing aspects of solar (15%), the challenges of upgrading the roof or electrical system in their house (15%), and understanding how the technology works (13%). Several respondents wrote in their own responses, with one noting that the restrictions of their utility was their primary barrier and another wrote that “Maintenance is very costly in the long run, solar energy is not reliable because sunlight cannot be controlled. Solar systems have too little time on the market to know if it is a good thing in the long term.”

We have learned from this process that residents of the 956 have relatively positive views of solar. In addition, 67% of respondents agreed that “the installation of solar panels should be encouraged by governments/electric utilities.” While the results of the survey paint a largely positive perception of solar in South Texas, there were several notable responses that stood out as potential areas of concern. News reports have also detailed several cases where solar companies have engaged in unscrupulous activities, not only directly hurting vulnerable community members, but also potentially damaging the reputation of solar installers and the rooftop solar initiatives that organizations like TEPRI are working to expand, such as with our recent award from the Environmental Protection Agency’s Solar for All program. High costs continue to be the number one barrier to the expansion of rooftop solar, yet only about a third of respondents reported being knowledgeable of all solar incentives that are currently available.

As we move forward, there are many opportunities to improve how South Texas residents interact with solar companies to ensure they make the best decisions for their households. For one, more robust, unbiased educational resources will help to guide consumers in the right direction. For many households interested in energy bill reduction, solar may not be the most cost effective option. Energy efficiency upgrades ranging from simple door weatherization strips to more robust attic and wall insulation can be lower-cost ways of achieving long-lasting energy savings without the need for a costly and complicated solar installation. Initiatives like Por Texas Para Todos have already begun to lead this charge, providing RGV residents with resources to help make decisions around solar. Solar initiatives that are designed for low-to-moderate-income households, like Solar for All and TEPRI’s solar program with come dream. come build. (CDCB) in Brownsville, will also help to provide more flexible, less invasive ways to expand access to solar in underserved communities. Community solar initiatives, while complicated in the Texas deregulated energy market, can be effective ways of delivering clean energy and cost savings to lower income households without the need for individual families to place expensive assets on their roofs. These and other opportunities pave the way for the future of solar in South Texas.

If you’d like to learn more about the survey or TEPRI’s work with solar in South Texas, please reach out to Andrew Robison, Program Manager, at andrew@tepri.org.