As 2022 comes to a close, it is becoming ever important to both examine how this year’s energy events are impacting low-income families across the state and to keep an eye on major changes yet to come. This year was especially turbulent for Texas energy customers.

True Costs of Winter Storm Uri

Back in January, the state marked one year since Winter Storm Uri left millions of Texas families without vital electricity and heat during record low temperatures, resulting in over an estimated 700 deaths. As we near the second anniversary of the storm, there are still unanswered questions about the stability of the Texas grid, how policymakers plan to address these stability issues, and how much customers will have to shell out to make it happen.

The state floated $6.3 billion in bond money to Texas utilities and energy companies to keep balance sheets in order after the storm. Now that the dust has begun to settle, energy customers across the state are wondering how much more in extra charges will be added to their bills for the next 10, 15, or even 30 years. Despite the high profile of the winter storm and the astounding costs associated with the event, transparency around specific bill increases remains opaque. Utilities, energy companies, and retail electric providers are each taking different approaches to how they plan to recoup costs incurred during the storm. As an example, below is a brief summary of what various state agencies and electricity and gas companies have gone on record to say about Uri-related bill increases in the greater Dallas area:

| Agency or Utility | Comment on the record as of November 11, 2022 |

| Public Utility Commission of Texas (PUCT) | “…improvements to strengthen electricity reliability are costing customers about $1.18 for 1,000 kilowatt hours per month.” (Based on calculations provided by ERCOT) |

| Electric Reliability Council of Texas (ERCOT) | To help repay $2.9 billion in bond debt for electricity customers, “customers will pay costs up to $0.697 per 1,000 kWh. This will decrease to $0.627 after the first six months, she said. Final payment for these bonds comes in 2050. Also, companies that suffer from deep debts will get assistance with a pass-through to customers charging $0.026 per 1,000 kWh. Final payment for these bonds is 2049.” |

| Texas Railroad Commission (TRRC) | “TRRC is handling $3.4 billion in bonds for gas-related companies. Some or all will be passed through to customers.” |

| Atmos Energy | No official response, but estimates from Atmos Energy put bill increases at somewhere between $3.50 and $5.50 per month for the next 10-15 years. |

| TXU Energy and Gexa Energy | No official response. |

| Reliant Energy | Reliant spokesperson Megan Talley said, “We are not passing the costs to customers.” |

| CoServ | “…will add an additional 6/10ths of a cent per kWh on a monthly bill, which is about $5.70 for a household that uses 1,000 kWh. This add-on starts in January.” CoServ did not receive money from the state’s bond program. |

| Tri-County Electric | “…an as-yet unknown amount [will] show up on bills as early as January. It will be listed as “Brazos Bankruptcy Fee.”” Tri-County Electric incurred $480 million in debt from the storm. |

| Oncor | Oncor is currently working to get approval from regulators for an 11% increase on a monthly bill. That would be about $6 a month more for the typical customer. |

From the perspective of a typical energy customer, or even from a seasoned energy industry expert, these estimated charges are difficult to understand and even harder to prepare for in the coming years.

Inflation and Energy Cost Spikes

These additional fees on energy bills come at a time when households are already stretched thin. Family budgets are especially tight as the country experiences its highest levels of inflation in over 40 years, peaking at 9.1% in June and averaging around 8% for the last 12 months. A large portion of this inflation has been driven by high energy prices, made worse by events like Russia’s invasion of Ukraine and other major geopolitical events across the world. Inflation uncertainty has only added insult to injury to the unknown costs associated with Winter Storm Uri debt repayment and PUCT market redesign efforts (discussed in depth further below).

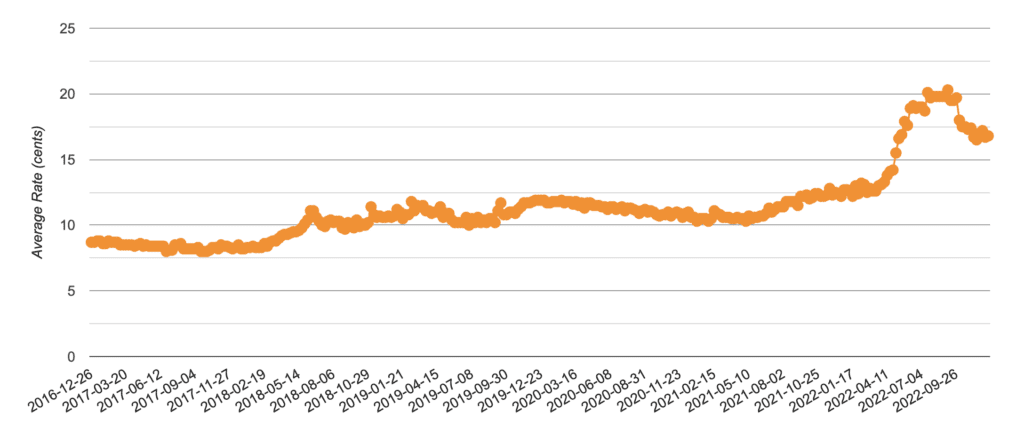

Retail electricity rates peaked at an average of over 20 cents per kilowatt-hour (¢/kWh) during the hottest months of 2022 – an over 75% increase year over year. While these rate spikes are felt differently by different households across the state due to differences in electricity plan offerings, utility type, and contract lengths, these rising energy rates have put even further stress on household incomes amid high inflation. Previous TEPRI research has identified that, in the face of high energy bills, low-income customers are often forced to make difficult tradeoffs. Families often have to forgo spending in other categories like clothing, food, and medicine to pay energy bills, or else risk running into bill delinquency. Texas households, particularly historically marginalized communities and those with the lowest incomes, are facing unprecedented economic pressures for everyday essentials, especially energy.

Grid Reliability

As winter months approach and temperatures dip, Texans are wondering if the ERCOT grid is prepared to withstand another extreme winter weather emergency, especially as they shell out more money to pay for when it could not. On November 29th, PUCT Chairman Peter Lake and ERCOT CEO Pablo Vegas held a briefing to assure the public that the grid is now better prepared than ever before to endure extreme winter weather events. They pointed to improvements in natural gas infrastructure and “increased and improved communication between TRRC, the Texas Department of Transportation (TxDOT), the Texas Division of Emergency Management (TDEM), the Texas Commission on Environmental Quality (TECQ), the PUCT, and ERCOT” as key indicators of future grid reliability. Similar sentiments were echoed at a Texas House of Representatives State Affairs Committee meeting on December 5th, 2022, where lawmakers had the opportunity to question Chairman Lake and Mr. Vegas about the current state of the grid and proposed reliability measures as part of the PUCT’s ongoing market redesign process.

Nevertheless, estimates from ERCOT itself show that there are still risks that, in the face of a very high demand for power, would necessitate the need to issue calls for energy use reduction or, in certain circumstances, enact power outages. ERCOT’s Seasonal Assessment of Resource Adequacy (SARA) reports, which are issued ahead of each season change, “serve as early indicators of the risk that ERCOT may need to call an Energy Emergency Alert Level 1 (EEA1) due to having insufficient operating reserves during seasonal peak electric demand periods.” Rolling blackouts would be necessary in a scenario in which there is high electricity usage, low solar and wind production, and power plant outages.

Chairman Lake and Mr. Vegas argued that the ERCOT SARA report fails to account for all of the ways in which protection measures and agency reforms have helped improve grid reliability, including “better communication and coordination.” The SARA report estimated that ERCOT, largely by weatherizing the energy fuel supply, has made efforts to reduce unplanned plant outages by 90% compared to those seen during the 2021 winter storm.

An October report from the Federal Energy Regulatory Commission (FERC) voiced similar concerns, even after being reevaluated after state regulators voiced concerns about the report’s methodology. The report states that ERCOT’s preparedness for extreme winter weather events similar to Winter Storm Uri is only “marginally better” – even after more than 18 months of time to increase preparedness and reliability. Market regulators did work to weatherize power plants and some natural gas infrastructure, helping to avoid repeat circumstances from Winter Storm Uri. Little has been done to reduce electricity demand across the board, which has only increased as the state continues to grow in both population and economic might. Estimates from the FERC report show that electricity demand during a winter peak event could exceed supply by over 18,000 megawatts (mW), enough to power roughly 3.6 million households. While the focus of grid reliability has focused more on reliability under extreme conditions, the report estimates that ERCOT will have more than enough energy to meet winter demand under normal conditions.

More recently, a December 15 report from the North American Electric Reliability Corporation (NERC) warned that the reforms to ERCOT grid reliability are not enough to withstand another extreme weather event. Similar to the October FERC report, the NERC report acknowledges that “improved generator availability resulting from winter preparedness programs and reforms implemented by Texas regulators, ERCOT, and generator owners since February 2021 are expected to reduce the risk that electricity supplies will be insufficient during a severe winter storm.” However, the report also addresses demand-side energy consumption, discussing how the state has not adopted additional energy efficiency standards or energy conservation programs to reduce energy usage across the board. NERC also placed priority on long-term winter weather and demand forecasting in particular for southern states like Texas, where winter weather peaks vary by year and are often unable to rely on solar power to meet peak demand.

Reliability and Market Redesign

During the 87th Legislative Session in 2021, lawmakers passed Senate Bill 3 (SB 3) which required the PUCT to create and implement a reliability standard for the grid. Unlike other grid operators, ERCOT has what is commonly referred to as an “energy-only” market, which simply put means that electricity generators can only make money through the supply of electricity. Generators have to cover their fixed and variable costs solely through the energy market. Texas and ERCOT do not have what is referred to as a “capacity market,” meaning there is currently no mechanism to pay power plants and other energy resources to be available for when demand begins to outpace supply. In other electricity markets, the capacity market helps to provide a fixed revenue source to generators, which can help improve grid reliability and promote the construction of new generation capacity. Electricity generators in ERCOT have typically relied on spikes in energy prices to earn enough money to invest in the creation of new power plant capacity, which can be a volatile process from a business standpoint. Many have pointed to ERCOT’s “energy-only” market as one of the main reasons behind its ability to offer lower-cost, competitive electricity rates. Nevertheless, the events during Winter Storm Uri, coupled with changes to the state’s energy demand, have begun to reveal flaws in the “energy-only” market structure. The events of the storm made it clear that a capacity market reliability mechanism is paramount to ensure that electricity generators are available to deliver power during peak demand periods.

As such, leaders at the PUCT are currently in the process of weighing several market redesign strategies that aim to bolster grid reliability. They commissioned E3, a California-based consultancy, to evaluate several proposals that aim to bring about grid stability through different market mechanisms. Currently, the PUCT favors a solution commonly referred to as the Performance Credit Mechanism (PCM). In short, the PCM:

- Provides that “load serving entities” (LSEs), which include municipal utilities, co-ops, and retail electric providers (REPs), buy credits for power from a “reliable” energy source

- Credits are awarded to power generators that are able to supply electricity to the grid during “high-risk” hours when excess grid operating reserves are at their lowest.

- In addition to the power consumed during high-risk hours, LSEs will then also be required to purchase the performance credits from power generators.

- Allows generators and LSEs to trade performance credits in a voluntary market

- Would also punish generators who failed to produce the power they promised with financial penalties.

Proponents of the plan argue that it will incentivize power generators to provide electricity from reliable sources of power in instances where they may have chosen to otherwise forgo electricity production. PUCT Commissioner Will McAdams noted that “It allows both loads and generation to make their business decisions based on the best available information possible going into the operating day,” calling the PCM a “hybrid of two models” that “adopts many of the best features” of capacity markets and an energy-only market.”

In the December 5th House State Affairs Committee meeting, Chairman Lake guaranteed Texas lawmakers that the PCM would result in the construction of new natural gas power plants, despite some skepticism from members of the committee. Earlier in the month, senators from the Business and Commerce Committee wrote a letter to PUCT’s commissioners expressing their concern that the PCM proposal may fail to meet the requirements of SB 3 and would not guarantee that new generation will be built “in a timely and cost effective manner.” Since then, lawmakers in both chambers have asked the PUCT to hold off on market redesign efforts until the legislature has time to fully review the proposal. The PUCT is set to vote on market redesign efforts on January 12th, 2023, but that vote will not be binding and the PUCT doesn’t plan on “operationalizing any market designs until we receive guidance from the Legislature,” according to Chairman Lake.

Critics of the plan argue that the PCM is much harder to design and operationalize than it’s being made out to be, not necessarily being able to deliver reliable sources of revenue to power generators. Additionally, modeling for the PCM did not include extreme weather conditions like those seen during Winter Storm Uri, making some worry about whether the PCM would help solve the problems that spurred SB 3 in the first place. The PUCT’s own report from E3 says that “Further analysis would be needed … to develop a corresponding reliability standard [to that winter storm]. Such analysis is beyond the scope of this study.” From an affordability standpoint, there are also concerns that so-called “gentailers,” which both generate and sell electricity, may be able to offer themselves favorable rates for performance credits, crushing market competition and resulting in higher rates for consumers.

Implementation of the PCM plan is also expected to cost Texas electricity consumers $460 million per year. From the perspective of lower-income electricity customers in the state, this additional increase in cost comes at an already extremely difficult time amid high energy prices and inflation. Even with such a high price tag, the PCM also fails to guarantee that the grid would be able to withstand additional extreme winter weather conditions, which has left many Texans wondering how they will fare in the face of another Uri-like event.

Major Decisions in 2023

As lawmakers and the PUCT continue to weigh major changes to the state’s energy market, uncertainty will remain for low-income energy consumers across the state. Nevertheless, there are large decisions on the horizon that spell optimism for improving conditions around energy affordability and sustainability in low-income communities. The PUCT and ERCOT are currently in the process of being reviewed by the Texas Sunset Advisory Commission, which may result in major agency changes. Major federal funding from the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA) continues to make its way to on-the-ground stakeholders to deliver meaningful impacts to communities in need. The PUCT will also decide on changes to its Energy Efficiency Implementation Plan (EEIP), which will inform the future of utility-funded energy efficiency investments in low-income and hard-to-reach communities across Texas. The Texas Legislature may also bring about further changes to the Texas energy system, beginning its session on January 10th.

TEPRI will continue to monitor all updates impacting low-income communities across the state. In conjunction with our statewide surveying effort, we aim to better understand how these changes (and proposed changes) may impact our mission of forwarding affordable, reliable, and clean energy solutions for low-income households.